The latest Ethereum (ETH) rally decoded - what pushed the ETH price up?

The past four weeks felt like a trip in a time machine back to 2021 as the entire cryptocurrency market has been painted green.Those who stake ETH were surely ecstatic, with the best Proof of Stake cryptocurrency leading the bulls' charge, gaining over 26% in this period and an impressive 57.8% since the commencement of a huge price swing in mid-October. But if we look at the big picture (by that I mean the weekly price chart), and zoom out a bit, it becomes clear that the latest Ethereum rally, which stirred the crypto community and global media, constitutes a part of a major uptrend that began in July 2022.

I kick off this in-depth ETH analysis with a clean chart, aiming to illustrate the strength and sustainability of the uptrend that the price action of the top PoS crypto has been constructing. This progress has persisted through the months when sellers dominated across all markets, thereby hindering interest in alternative crypto investments like Ethereum staking. Now, the tables have turned, with buyers taking the initiative and driving the price to a critical level at $2,400. In this move, they've established a third price peak, also known as a higher high, providing further confirmation of the bullish bias.

Naturally, even such a massive rally was bound to encounter a point of rejection, which stood at the mentioned price level. While ETH is going through a cooldown phase, let’s take a step back to analyze the reasons that fueled this bullish bonanza, ponder on the possible scenario of how things will move from here, and answer a critical question, “Is ETH staking profitable now?” Spoiler alert - yes, it is! But please be a good staking enthusiast and keep reading - perhaps this useful information would help you improve your ETH staking strategy for 2024.

Before delving into the nitty-gritty of technical analysis and assessing Ethereum staking profitability, it's crucial to consider the fundamental factors behind the recent surge in ETH price. Each candle on the price chart signifies an event, a change in sentiment, or a significant news release — these movements influence the market, along with crypto whales that operate behind OTC desks; they play a major role in shaping the future of the blockchain industry. Thus, grasping the fundamentals becomes crucial in understanding major price movements and their implications for related areas like crypto staking.

The Ethereum ETF speculations and expectations shape the market sentiment

On November 1, there was a great shift of crowd sentiment in favor of bulls, attributed to the news about the U.S. Securities and Exchange Commission (SEC) recognizing Grayscale Investment's bid to convert its Ethereum trust into an ETF. For your information, an ETF, short for ‘exchange-traded fund,’ is a financial product that tracks the performance of a cryptocurrency ETH, or a basket of digital assets, allowing investors to participate in crypto price changes without owning the assets directly.

The ETF is such a buzzword and a driver of market rallies because it’s seen by many as a gateway for conservative investors into crypto, who prefer a highly regulated environment, something that isn’t characteristic of the contemporary blockchain industry. Transforming a trust into an ETF ought to improve market accessibility, liquidity, and transparency, thus offer investors more convenient trading options. This shift aligns with the increasing demand for ETFs and the strive for mass adoption of cryptocurrencies and associated financial products.

However, the SEC's approval process for ETFs has been facing numerous challenges. Grayscale Investments, seeking approval for its spot Bitcoin and Ethereum ETFs, recently received a mandate from the United States Court of Appeals, compelling the SEC to review its initial decision. Despite the court reaffirming its ruling and granting Grayscale another chance to fight the stubborn regulator, the SEC has not approved any spot crypto ETF for U.S. exchange listing, while favoring investment vehicles related to Bitcoin and Ether futures.

At the moment, there are as many as seven ETF applications pending SEC’s approval, including other investment management companies like Invesco and Galaxy Digital, but the agency postponed the decision on the Grayscale spot Ethereum ETF until January 2024. Despite these delays, the anticipation that the regulator will eventually yield to the pressure has revitalized market sentiment, subsequently propelling the ETH price to new local highs.

Ethereum sees a significant inflow of capital from institutional investors

While being somewhat frustrating - there's no other way with regulators, though - the largely positive expectation of ETF approval, or at least the unsaid declaration of intention to approve, served as a signal for institutional investors that it's time to pump money into crypto, mostly in Bitcoin and Ethereum.

According to Bloomberg and CoinShares, in the preceding 10 weeks, the cumulative inflow reached a noteworthy $1.76 billion, marking the highest level since October 2021. These record-breaking inflows also translated into net flows of Ether, becoming net positive by $10 million for the first time this year, with a substantial increase of $30 million in the past week alone. The total volume of capital inflow over the 5-week period has surged to $134 million, a compelling signal of sentiment shift after an extended period of bearish bias.

Such investment behavior signals a growing confidence among large investors, suggesting the impending end of the crypto winter. The broadening of capital flow also reflects the anticipation that the better regulatory framework, both in the United States and worldwide, will bring clarity and attract new money to the crypto market.

The anticipation of the Proto-Danksharding upgrade has driven the ETH price up

Ethereum is rightfully considered one of the best Proof of Stake cryptocurrencies, and surely the top crypto for staking; however, even after several network upgrades, including by far the most important one—the Merger—it still has major scalability issues. Needless to remind you that scalability problems can cause delays and higher fees, impacting the experience for ETH stakers.

This may affect transaction processing and rewards, making ETH staking less efficient. It lingers since the first major network congestion caused by CryptoKitties - you must remember this cute blockchain-based game back from 2017, where players could breed and trade virtual cats that were also the first non-fungible tokens (NFTs) that gained massive popularity and became the harbingers of the later NFT boom. This 'cursed' popularity then showcased the weakness of the Ethereum blockchain network in the face of a sudden influx of transactions which resulted in network clog-ups and sky-high network fees - the problem that persists in 2023.

For example, during the analyzed surge in the ETH price, which corresponded with a spike in certain network activity, the nature of which I’ll explain in the next part, there was a significant upswing in daily fees and revenue, reaching a 180-day peak by the close of the first week of December. In the span of 30 days, fees surged over 155%, corresponding with the ETH rally. And while high fees are beneficial for network revenue, which has also experienced a 178.2% increase in the past month, equivalent to an annualized figure of $2.92 billion, they are detrimental to the network efficiency, usability, and further adoption.

Basically, scalability is one of only a handful of things that is holding back Ethereum from dethroning Bitcoin. The Merger has successfully resolved the energy consumption problem - the network currently consumes 99% less electricity than it did during the Proof of Work era; security has also been vastly improved through the series of Ethereum 2.0 upgrades.

Proto-Danksharding, the first answer to the scalability issue

Once again, scalability and the resulting high network fees remain the scourge of the top Proof of Stake blockchain, though many in the crypto community are convinced that the Danksharing upgrade, the final phase of Ethereum 2.0 (Serenity), will iron out this major difficulty and make Ethereum a 'truly scalable blockchain."

It's designed to open up more block space on Ethereum, allowing for efficient off-chain processing by multiple Layer 2 scaling solutions like EVMs and ZkEVMs running simultaneously. This temporary scaling solution aims to make Layer 2 transactions as affordable as possible for users. Here is a concise explanation of what Proto- Danksharding will bring to the table:

- New Transaction Type: Introducing "blob-carrying transactions" for extra data space.

- Blob Limits: Proto-Danksharding allows 16 blobs per block, each up to 128 KB (2 MB total). Danksharding increases this to 256 blobs.

- Storage: Storing all blobs in a sidecar on the consensus layer.

- 2-Dimension Fee Market: Proto-Danksharding uses a two-dimensional fee system for blob-data, making sure gas and data limits aren't exceeded together.

- KZG Commitments: Using a cryptographic commitment scheme known as "Kate-Zaverucha-Goldberg commitments" for data privacy, letting the EVM see only a commitment, not the actual blob data.

And while the full-fledged implementation of Danksharding is many, many months (and screw ups) away, a vital intermediate phase called Proto-Danksharding, or Ethereum Improvement Proposal (EIP)-4844, should be introduced in early 2024. The successful introduction of the upgrade will raise the network throughput to 100,000 transactions per second, thus vastly improving the scalability characteristics.

Proto-Danksharding and the full Danksharding implementation are crucial fundamental factors influencing the current and future price of ETH. The optimism among those who trade and stake Ethereum, as well as dApp developers, about the 'Proto' upgrade creates positive sentiments, driving up the price of this top PoS coin as everyone looks forward to enhanced transaction capabilities and lower costs with layer 2 scaling solutions. The anticipation of these improvements serves as a driving force in the crypto market, shaping interest and influencing ETH's valuation.

As you know, price rallies in the crypto market, and traditional markets as well, occur when the community is abuzz with expectations. In the case of Ethereum, the anticipation for Proto-Danksharding, and the upcoming Danksharding, has not only triggered the latest rally but may continue to fuel one or two more before the initial upgrade is rolled out.

Ethereum turns deflationary again as validators are exiting the pools

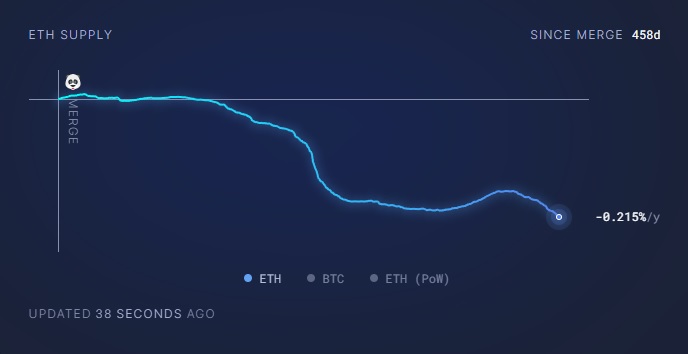

Additionally, the Ethereum network's growth has led to an increase in gas fees, transitioning the network back to a deflationary state. The last time Ethereum network emissions were inflationary was on November 8, indicating sustained activity growth in the last month. If this trend persists, Ether's coin supply will contract by -0.47% annually, whereas the chart below shows that the ETH supply is down 0.215% since the Merge.

The basic economic principle of supply and demand indicates that when the supply of an asset like ETH decreases and demand stays the same or rises, the price is likely to increase or even rally. As Ethereum becomes more deflationary, with a gradual and consistent reduction in coin supply, this creates a more bullish bias, making the current and future uptrends more sustainable. But for the moment, we need to figure out the reason behind ETH's latest turn to deflationary state, which as things appears, occurred due to the notable exodus of staking validators.

For now, we need to understand the reason behind ETH's recent shift to a deflationary state, which seems to have resulted from a significant exodus of staking validators. Data from the on-chain analysis platform Glassnode reveals a notable change in Ethereum's staking pool since October, with the growing number of validators leaving the pools every day. Such 'abandoning' behavior aligns with the rising digital asset prices. The Total Effective Balance in the Staking Pool, representing actively staked ETH, is slowing down and experiencing its first decline since the Shanghai upgrade.

The growth rate of the Total Effective Balance has dropped significantly since mid-October, showing less than half the growth rate since May. The exodus of validators, mainly voluntary exits, have been led by centralized exchanges like Kraken and Coinbase. Liquid Staking Providers, especially Lido, also saw a slight increase in withdrawn stake, whereas non-custodial staking providers like CryptoStake didn't record any noticeable changes in validator behavior.

Possible reasons for this include investors changing their staking setup, potential regulatory concerns leading to a shift from centralized exchanges and liquid staking platforms to safer solutions, such as non-custodial staking.

Moreover, holders may prefer to hold unstaked ETH for its increased liquidity, anticipating the continuation of the market uptrend. In summary, recent network activity, characterized by heightened token transfers and stablecoin usage, indicates a growing confidence in the strength of the Ethereum market, though the provided data suggest a slowdown in staking activity within the underlying blockchain network.

Price chart analysis: examining the ETH rally in the big picture

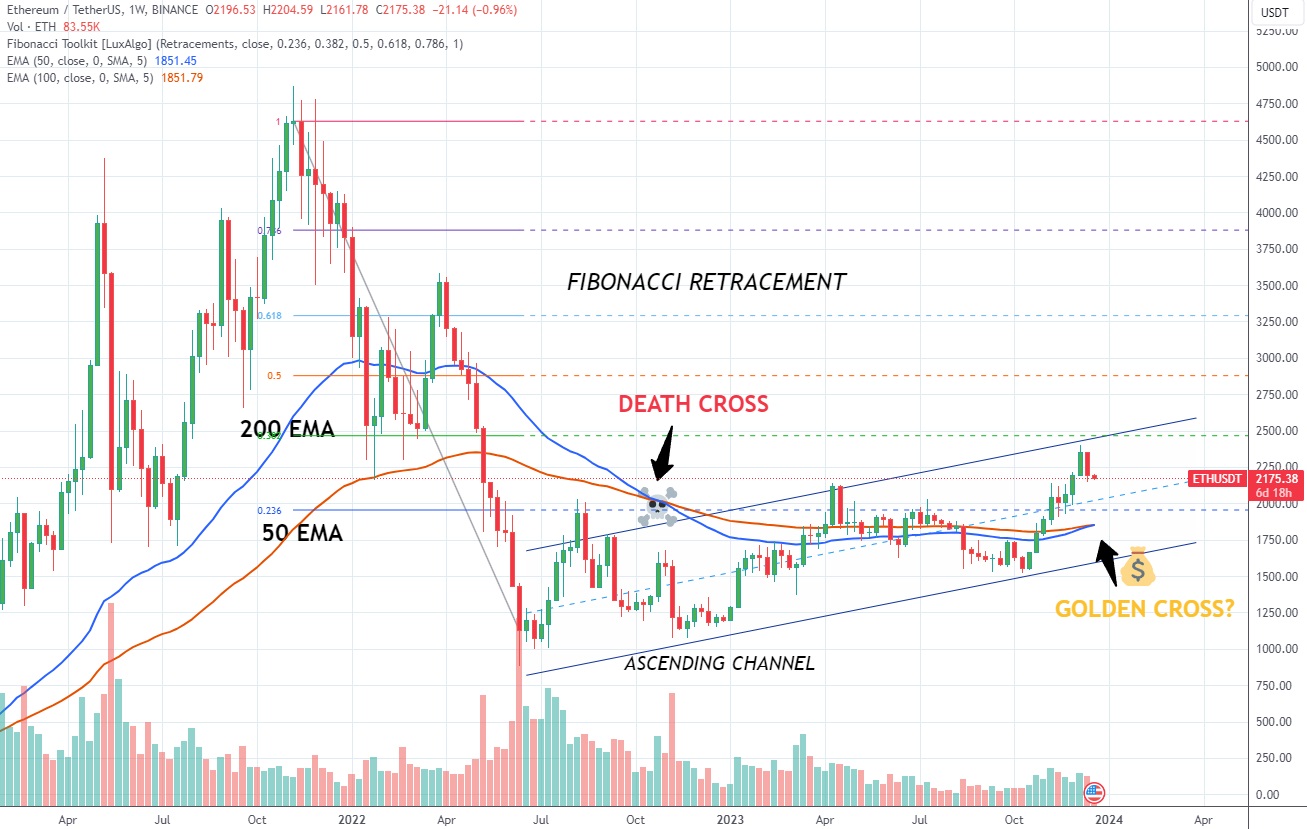

Before the actual analysis, I would like to give a quick overview of everything that you are going to see on the weekly ETH/USDT chart:

The orange line represents a 50-period Exponential Moving Average (EMA), commonly used as an indicator to identify trends, dynamic support or resistance levels, and crossovers. Crossovers occur when the 50 EMA crosses the higher EMA (in this case, the 200 EMA) to the upside, forming a golden cross, or to the downside, forming a death cross.

The blue line is a 200-period EMA which serves the same purpose, but it is calculated on the closing price of the last 200 periods, which provides a smoother, thus more long-term, perspective on price trends.

The two upward-sloping parallel lines above and beneath the price action candles from June 2022 til now represent an ascending channel, a pattern that indicated an uptrend with price bottoms and peaks, known as higher lows and higher highs.

Several multicolored lines represent the Fibonacci retracement tool that works really well when there's a need to identify potential support or resistance levels in a price trend by using specific ratios (38.2%, 50%, and 61.8%) associated with natural retracement zones.

A cursory glance at the weekly ETH/USDT chart reveals the second-largest cryptocurrency's movement within a well-defined ascending channel since the end of June 2022. The uptrend commenced with a rebound following a significant 75.8% crash from around $3,600 to $880, a level from which it has yet to fully recover. This price behavior, considered in the context of Fibonacci retracement, indicates a crucial resistance level for ETH, expected to be challenged in 2024, lying between $3,300 and $3,600. Notably, the lower bound aligns with the 61.8% level on the Fibonacci grid.

For your information, the 61.8% Fibonacci level is significant as a key indicator often signaling shifts in market trends. Consequently, at CryptoStake, we anticipate ETH testing the $3,200 - $3,600 level by the end of Q2 2024. This projection is supported by the early appearance of a golden cross—where the 50 EMA crosses the 200 EMA upwards—a widely recognized strong bullish signal. In contrast, the last occurrence of a Death Cross, where the 50 EMA crossed downwards, led to a 35% drop in ETH's value within three weeks. If the Golden Cross unfolds as expected, the best cryptocurrency for staking could see a 55% increase before encountering a Hulk-like resistance, prompting some less foresighted holders and traders to sell en masse in an attempt to break even.

But before Ethereum revs up its engine, puts the pedal to the metal, breaks out of the ascending channel, and heads north, the top PoS crypto might take a pit stop, retracing to the 23.6% Fibonacci level around $2,000, or even giving those moving averages another test drive. Moreover, we see that the bottom of the ascending channel, and the potential lower high, lies around $1,750, which is where the price could drop sharply before attempting another rally. While the channel lines have been guiding the price pretty well, be wary of crowd behavior – they're on the same map, too. Look out for instances of liquidity hunt in either direction.

As of now, the most likely move for Ethereum is a correction to $2,000 with some consolidation. However, a surprise announcement about ETH approval or a concrete Proto-Sharding upgrade date could ignite a flash rally, breaking out of the channel and aiming for $2,700 or beyond. But remember, in the crypto realm, channels can break in any direction, and volatility rules the road. So, don't neglect risk management; place your stop losses wisely, not just where a YouTuber "mega-trader with a shizillion winrate' suggests. Keep in mind, 'big boys' exploit crowd weaknesses, especially the tendency to 'trade by the book.' So here's a hint (not financial advice): avoid placing your stop loss directly under a moving average or an obvious support level.

Bottom line: what does the near-term future hold for the best cryptocurrency for staking?

The approval of an Ethereum ETF stands as a pivotal factor that could shape the trajectory of ETH in 2024. The significance lies in its potential to catapult Ethereum to new price highs, potentially reaching or surpassing all-time records. A successful ETF approval is anticipated to attract substantial institutional capital, boosting market sentiment and fostering a bullish trend.

Conversely, a failure to secure approval might dampen the prevailing bullish bias, injecting uncertainty and potentially triggering a deep correction. The repercussions extend beyond ETH, influencing the broader crypto market. As the crypto community eagerly awaits regulatory decisions, the outcome regarding the Ethereum ETF looms large, holding the power to either fortify or disrupt the current positive momentum.

The recent surge in Ethereum's value is undeniably intertwined with the anticipation surrounding the forthcoming Danksharding upgrade. A pivotal precursor to this, Proto-Danksharding, holds the potential to significantly enhance Ethereum's adoption, utility, and market dynamics. The positive sentiments generated by this impending upgrade serve not only as a driving force for market rallies, but also signal potential for sustained growth in Ethereum's market price and the popularity of ETH staking.

The recent ETH rally, while prompting a brief validator exodus, has rendered the cryptocurrency more deflationary, potentially enhancing its long-term value. As market conditions stabilize, validators may likely return, recognizing the benefits of non-custodial staking over liquid staking. This shift toward deflation, driven by increased demand and decreased supply, contributes to a more bullish outlook for Ethereum, paving the way for sustained value appreciation in the future.

Technical analysis indicates a sustained bullish trend for Ethereum, supported by fundamental factors. The near-term trajectory hinges on ETH's efforts to rebound from previous bear market capitulations. Despite these challenges, the short-term outlook remains optimistic, contingent on the unfolding of favorable fundamental factors. Investors are closely monitoring its price action while those who stake ETH await network improvements and higher prices to improve their portfolios.